- Coinpaper Digest

- Posts

- WLFI Torches 47M Tokens!

WLFI Torches 47M Tokens!

World Liberty Financial burned 47 million WLFI tokens after its price plunged.

A Private Circle for High-Net-Worth Peers

Long Angle is a private, vetted community for HNW entrepreneurs and executives. No membership fees. What’s inside:

Self-made professionals, 30-55 years old, $5M-$100M net worth

Confidential discussions, peer advisory groups, live meetups

Institutional-grade investments, $100M+ invested annually

Here's what we've got for you today:

World Liberty Burns 47M Tokens in Bid to Pump Price as Slide Continues

Bitcoin ETFs See $332 Million in Inflows, Ending Ethereum ETF Flow Dominance

Ethereum Foundation to Sell $34M in ETH for Ecosystem Building

CleanCore Plunges 60% After Unveiling $175M Dogecoin Treasury Strategy

World Liberty Financial burned 47 million WLFI tokens after its price fell over 30% since launch.

The Trump family’s World Liberty Financial (WLFI) project burned 47 million tokens, permanently removing them from circulation.

WLFI launched on Monday, and briefly peaked at $0.331 before declining over 30%, now trading around $0.22.

The token burn is a supply-tightening strategy that is aimed at stabilizing or boosting WLFI’s market value.

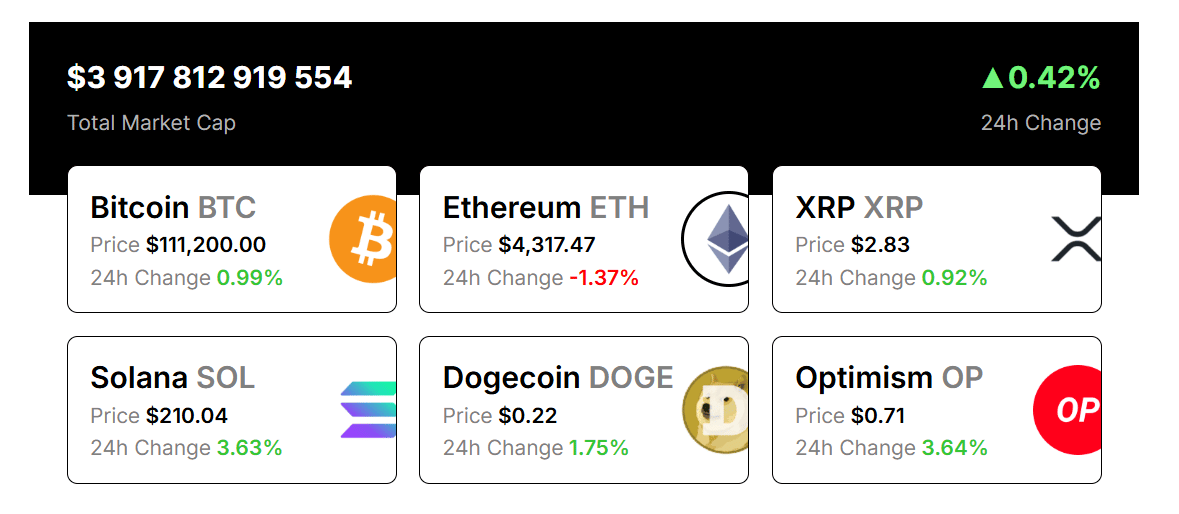

Spot Bitcoin ETFs attracted $332.7 million in net inflows on Tuesday, while Ethereum ETFs saw $135.3 million in outflows.

Spot Bitcoin ETFs recorded $332.7 million in net inflows Tuesday, led by Fidelity’s FBTC ($132.7M) and BlackRock’s IBIT ($72.8M).

Spot Ethereum ETFs saw $135.3 million in net outflows, with Fidelity’s FETH (-$99.2M) and Bitwise’s ETHW (-$24.2M) leading the declines.

Analysts suggest that institutions are rebalancing toward Bitcoin’s stability, while Ethereum previously outperformed in August due to yield potential and regulatory clarity.

The Ethereum Foundation announced that it will sell about $43 million worth of ETH over several weeks to fund grants, research, and ecosystem growth.

The Ethereum Foundation (EF) plans to sell 10,000 ETH over several weeks via centralized exchanges to fund ecosystem growth, R&D, and donations.

The move follows EF’s pause of open grant applications and comes after distributing $32 million in grants in Q1 of 2025.

EF has a history of strategic ETH sales, including $25M to SharpLink Gaming earlier this year.

CleanCore Solutions will convert into a Dogecoin treasury company after raising $175M to acquire DOGE.

CleanCore Solutions’ stock plunged over 60% on Tuesday after unveiling plans to transform into a Dogecoin treasury company.

The firm raised $175 million from over 80 institutional and crypto-native investors, including Pantera, GSR, FalconX, and Borderless, to buy DOGE as its primary reserve asset.

Leadership changes include Elon Musk’s attorney Alex Spiro as board chairman, while Dogecoin Foundation’s Timothy Stebbing and House of Doge CEO Marco Margiotta join as board member and CIO.

👀 QUICK NEWS

Crypto Exchange Volume Tops $1.8 Trillion in August, Highest Monthly Level Since January

Crypto Exchange OKX Fined $2.6M in Netherlands for Failing to Register with Dutch National Bank

Crypto.com CEO Bets on Fed Rate Cut to Fuel Crypto Markets in Q4

S. Korea’s New Top Regulator Faces Scrutiny Over Strategy Shares

Hedge Fund Billionaire Ray Dalio Breaks Down What Could Make Crypto Outshine the Dollar

MEME OF THE DAY

How did you like today's newsletter? |

That’s it for today. Don’t forget to share Coinpaper Digest with your friends!