- Coinpaper Digest

- Posts

- Meme Coins Explode Higher to Start 2026!

Meme Coins Explode Higher to Start 2026!

Meme coin market capitalization jumped more than 23% in the first week of the new year.

Here's what we've got for you today:

Meme Coins Rip Into 2026 with 23% Market Cap Pump

Prediction Markets Face Scrutiny After Profitable Maduro Wager

PwC to Deepen Crypto Engagement Citing US Regulatory Shift: FT

Visa Crypto Card Spending Soars 525% in 2025

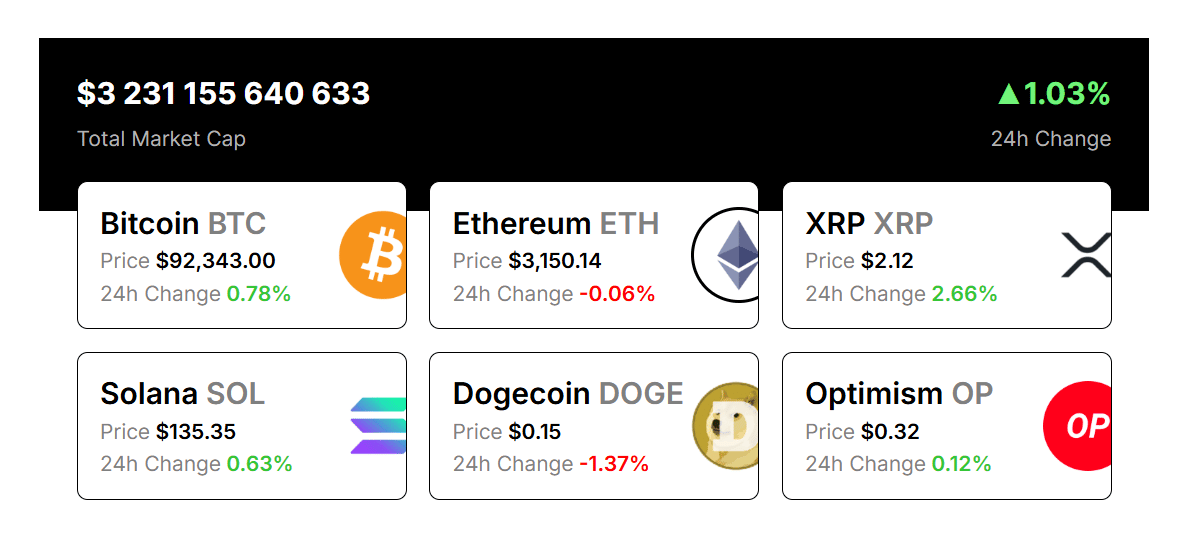

Meme coin markets staged a sharp early-2026 rebound, with market caps and trading volumes surging.

Meme coin market capitalization jumped more than 23% in the first week of the new year, rising from $38 billion on Dec. 29 to $47.7 billion.

The top three meme coins all recorded double-digit weekly gains, led by Dogecoin (+20%), Shiba Inu (+19.9%), and Pepe (+65%).

Meme coin transaction volume surged nearly 300% week-over-week, climbing from $2.17 billion to $8.7 billion, suggesting traders are again willing to take on higher-risk positions.

US lawmakers are preparing new legislation to limit insider participation in political prediction markets.

US Representative Ritchie Torres is preparing legislation to restrict how government insiders participate in political prediction markets after controversy tied to trades around Venezuelan President Nicolás Maduro.

The proposed Public Integrity in Financial Prediction Markets Act of 2026 will bar federal officials, political appointees, and executive branch employees from trading prediction contracts linked to policy or political outcomes when they possess nonpublic information.

The legislative push follows a highly profitable wager on Polymarket, where a newly created account reportedly turned $32,000 into a large profit by betting on Maduro’s removal from office before the reported capture.

PwC is moving to embrace cryptocurrency and tokenization, due to new US stablecoin legislation and a more supportive regulatory climate.

PwC is moving to embrace cryptocurrency after years of caution, with US Senior Partner and CEO Paul Griggs saying the firm has decided to “lean in” to crypto-related work.

Griggs pointed to the passage of the GENIUS Act and stablecoin rulemaking as key catalysts. He also added that tokenization will continue to expand and PwC “has to be in that ecosystem.”

PwC’s move follows a broader pro-crypto turn among US regulators after the reelection of Donald Trump.

Visa-issued crypto cards saw net spending surge more than 500% in 2025.

Visa-issued crypto cards recorded a 525% increase in total net spend last year, rising from $14.6 million in January to $91.3 million by December.

Among the six Visa-partnered cards tracked, EtherFi led by a wide margin with $55.4 million in total spend, followed by Cypher at $20.5 million.

A researcher from Polygon said the growth sheds some light on accelerating adoption of crypto cards and cements crypto and stablecoins’ strategic role within Visa’s global payments ecosystem.

👀 QUICK NEWS

Hut 8 Expands Coinbase Credit Line to $200M as AI Push Accelerates

Ethereum Ready to Solve Blockchain Trilemma: Vitalik Buterin

Bitcoin Core Sees Development Uptick, Reversing Multi-Year Decline: Casa CSO

Wallet Drainer Phishing Losses Fall to $84M in 2025, Down 83%

Weekend Crypto Buzz: Bitcoin Goes Beast Mode Amid Reclaiming $90K

MEME OF THE DAY

How did you like today's newsletter? |

That’s it for today. Don’t forget to share Coinpaper Digest with your friends!