- Coinpaper Digest

- Posts

- Don’t Count on a New Year Bitcoin Boom...

Don’t Count on a New Year Bitcoin Boom...

Ophelia Snyder warns that Bitcoin may struggle to replicate its early-2025 rally in January 2026.

Here's what we've got for you today:

Bitcoin Unlikely to Replicate January’s Surge to New High: 21Shares Founder

CNBC Partners With Kalshi to Bring Prediction Data to Viewers

JPMorgan Says Strategy's Resilience is Key to Bitcoin's Price Direction in the Near Term

Solana and Coinbase’s Base Connect Together Using Chainlink

Ophelia Snyder warns that Bitcoin may struggle to replicate its early-2025 rally in January 2026.

21Shares co-founder Ophelia Snyder says Bitcoin is unlikely to repeat its strong early-2025 gains in January of 2026 due to unresolved market volatility and weak sentiment.

She pointed out that January typically brings renewed ETF inflows as investors rebalance, but this trend may be muted next year.

Overall, Bitcoin’s January performance is uncertain, especially with sentiment still subdued despite its previous peak of $109,000 tied to expectations around Donald Trump’s crypto plans.

CNBC will integrate real-time prediction data from Kalshi across its programming and digital platforms starting in 2026.

CNBC entered a multi-year partnership with prediction market operator Kalshi to integrate real-time event-probability data across its TV programming, digital platforms, and subscriber products starting in 2026.

Shows including Squawk Box and Fast Money will feature a dedicated forecast ticker, while Kalshi will host a CNBC-branded page with markets selected by the network.

Executives from both companies say the deal forms part of the shift toward using prediction markets as a core analytical tool in financial journalism, especially after Kalshi’s recent integration agreement with CNN.

JPMorgan says Strategy’s stability now has more influence on Bitcoin’s short-term price than miner activity.

JPMorgan analysts say Strategy’s resilience is a more important driver of Bitcoin’s near-term price outlook than miner selling.

Bitcoin is still under strain due to falling network hashrate and mining difficulty, driven by China’s renewed enforcement of its mining ban and high-cost miners shutting down abroad.

Despite lower difficulty, analysts pointed out that Bitcoin is still trading below its production cost, keeping sell pressure elevated across the mining sector.

Solana and Base are now bridged via Chainlink’s CCIP, enabling cross-chain trading and native support for Solana assets across Base applications.

Solana and Coinbase’s Base network are now connected through a new bridge powered by Chainlink’s CCIP, enabling seamless cross-chain asset transfers.

The bridge is live on mainnet and rolling out across apps like Zora, Aerodrome, Virtuals, Flaunch, and Relay, allowing users to trade SOL and Solana-based assets directly on Base.

Developers on Base can now integrate Solana assets, including SPL tokens, as both chains continue to grow—Solana with $9 billion locked and Base with $4.5 billion.

👀 QUICK NEWS

XRP Sentiment Plummets, Which Could Set Token Up for Rally: Santiment

“First Time Ever”: CFTC Greenlights Spot Crypto Trading on Regulated U.S. Exchanges

CZ Pushes to Make America a Global Crypto Capital as Binance Eyes US Expansion

IMF Warns Stablecoins May Accelerate Currency Substitution, Weaken Central Bank Control

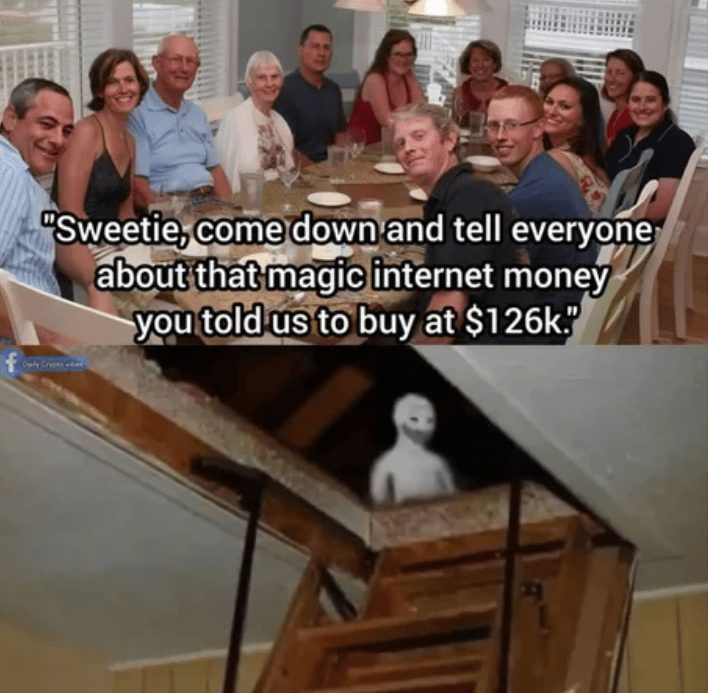

MEME OF THE DAY

How did you like today's newsletter? |

That’s it for today. Don’t forget to share Coinpaper Digest with your friends!