- Coinpaper Digest

- Posts

- Bitcoin Trails Gold, but 2026 Could Flip the Script!

Bitcoin Trails Gold, but 2026 Could Flip the Script!

Bitcoin and the crypto market are lagging traditional assets, but this could create an opportunity for crypto to “play catch-up.”

Here's what we've got for you today:

Crypto Lagged Gold, Stocks, but 2026 Offers Chance for ‘Catch Up’

CZ Says Pakistan Could Become a Global Crypto Leader by 2030

Footballer David Beckham-Backed Healthcare Firm Will no Longer Buy Bitcoin

BitMine Bags $98M in ETH as Year-End Selling Caps Gains: Tom Lee

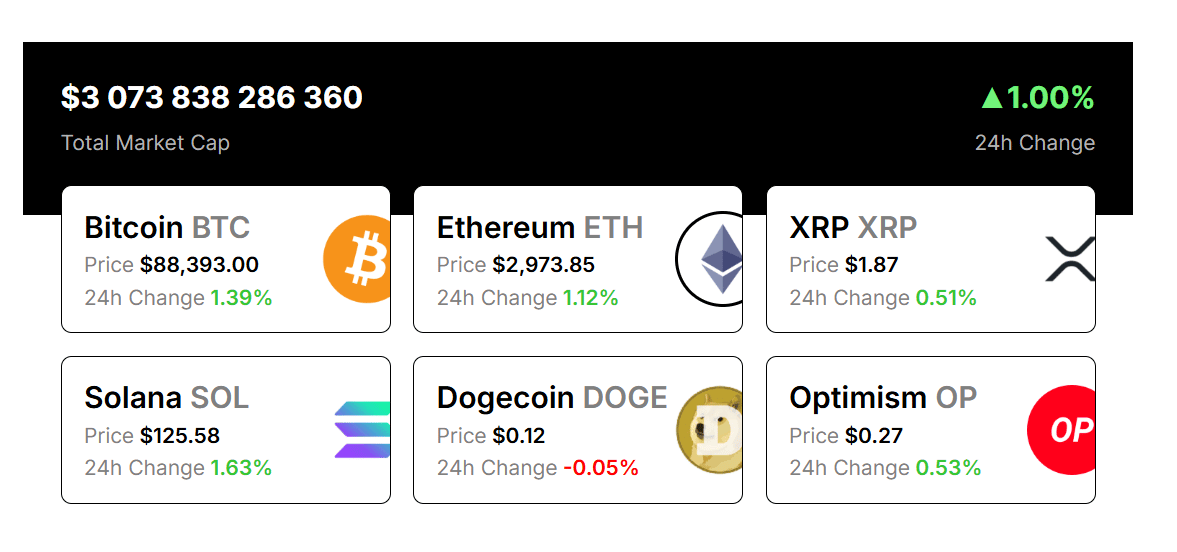

Crypto markets may continue to struggle into 2026 despite gains in gold and stocks.

According to Santiment, the crypto market is likely to remain under pressure into 2026, with Bitcoin down about 20% since November, while Gold is up 9% and the S&P 500 has gained 1%.

Santiment analysts say Bitcoin and the broader crypto market are lagging traditional assets, but this divergence could create an opportunity for crypto to “play catch-up.”

Large holders slowed accumulation in the second half of 2025, leaving smaller wallets as the primary buyers. A return of whale accumulation could signal a shift in market momentum, as big players are usually seen as key market movers.

According to Changpeng Zhao, Pakistan could emerge as a top global crypto hub by 2030.

Former Binance CEO Changpeng Zhao said Pakistan could become a leading global crypto hub by 2030 if it maintains its current pace of adoption and regulatory progress.

Zhao argued that Pakistan’s ability to move quickly and provide regulatory clarity gives it an edge over larger jurisdictions that move more slowly on crypto policy.

Pakistan has already taken concrete steps to formalize its digital asset ecosystem, including creating the Pakistan Virtual Assets Regulatory Authority, allowing exchanges like Binance and HTX to operate locally, and exploring real-world asset tokenization to attract foreign capital.

Prenetics Global halted its Bitcoin accumulation despite holding 510 BTC.

Prenetics Global stopped accumulating Bitcoin on Dec. 4 to shift its strategic focus toward building its nutrition supplement brand, IM8.

The company’s board said the pivot reflects a belief that IM8 represents the most promising path to long-term shareholder value.

Prenetics previously pursued an aggressive “1 BTC per day” strategy launched in August, and raised $48 million in an oversubscribed equity round to expand its Bitcoin treasury.

BitMine Immersion Technologies added nearly $98 million in Ethereum amid year-end market weakness.

BitMine Immersion Technologies bought $97.6 million worth of Ethereum on Tuesday according to Nansen data.

After the purchase, BitMine’s total Ethereum holdings stand at about 4.07 million ETH, worth roughly $12 billion, and the company also staked an additional 118,944 ETH as part of its strategy to generate passive returns for shareholders.

Tom Lee said the market weakness is partly driven by year-end tax-loss selling in the United States, a seasonal trend that typically peaks between Dec. 26 and Dec. 30 as investors sell assets to offset taxable gains.

👀 QUICK NEWS

Bitwise Files for 11 New Crypto ETFs Tracking Bittensor, Tron and Others

Solana Posts $1.5B Revenue Year, Flips Ethereum and Hyperliquid as Traders Watch $129

China Gains Major Advantage if US Bans Interest on Stablecoins, Coinbase Exec Warns

Russia Proposes Prison Time for Illegal Crypto Mining Operations

Uganda Opposition Leader Promotes Bitchat Amid Fears of Internet Blackout

MEME OF THE DAY

How did you like today's newsletter? |

That’s it for today. Don’t forget to share Coinpaper Digest with your friends!