- Coinpaper Digest

- Posts

- Bitcoin Entered Bear Market in November!

Bitcoin Entered Bear Market in November!

Bitcoin may already be two months into a bear market, according to CryptoQuant.

Here's what we've got for you today:

Metric Suggests Bitcoin Has Been in a Bear Market for 2 Months

Crypto Hack Losses Drop 60% in December

Iran Moves to Accept Crypto Payments in Weapon Sales to Evade Sanctions: FT

Vitalik Buterin Pushes Ethereum to Prioritize Long-Term Goals Over Trend Chasing in 2026

Bitcoin may already be two months into a bear market, according to CryptoQuant.

CryptoQuant’s head of research Julio Moreno says Bitcoin likely entered a bear market in early November, as most indicators in the firm’s bull score index turned bearish and have not recovered.

Moreno points to Bitcoin falling below its one-year moving average as the final confirmation, as it is a level widely used to distinguish between bull and bear market phases.

Bitcoin began 2025 near $93,000, peaked at about $126,080 in October, and ended the year lower, which undermines forecasts that 2026 will be the start of a renewed growth phase.

Crypto hack losses fell 60% in December to $76 million, but major incidents show that cybersecurity risks in the digital asset market are still high.

Losses from crypto-related hacks and exploits fell to about $76 million in December, a 60% decline from November’s $194.2 million.

PeckShield recorded 26 major exploits during the month, including one address poisoning scam that caused a single user to lose roughly $50 million.

Analysts warn that while December’s figures suggest a slowdown, deceptive attack methods like address poisoning continue to pose major risks to users and platforms.

Iran is reportedly open to accepting cryptocurrency payments for weapons exports.

Iran’s Ministry of Defence Export Center (Mindex) is prepared to negotiate weapons contracts that allow payment in cryptocurrencies, alongside barter deals and Iranian rials, according to a report by the Financial Times.

The policy is among the first known instances of a state-run arms exporter publicly indicating it would accept digital assets for advanced weapons like missiles, warships, and ammunition.

Facing extensive sanctions from Western powers that restrict access to global banking, Iran increasingly relied on barter trade and digital assets like Bitcoin to sustain trade.

Vitalik Buterin called on the Ethereum community to refocus on decentralization and long-term goals.

Vitalik Buterin urged the Ethereum community to prioritize the network’s original mission of becoming a truly decentralized “world computer,” and warned against chasing short-term trends or trying to “win the next meta.”

He acknowledged Ethereum’s major technical progress in 2025, including higher gas limits, expanded blob capacity, improved node software, and performance gains from zkEVMs and PeerDAS.

Buterin said the next challenge is turning those upgrades into real-world applications that operate without fraud, censorship, or reliance on third-party intermediaries.

👀 QUICK NEWS

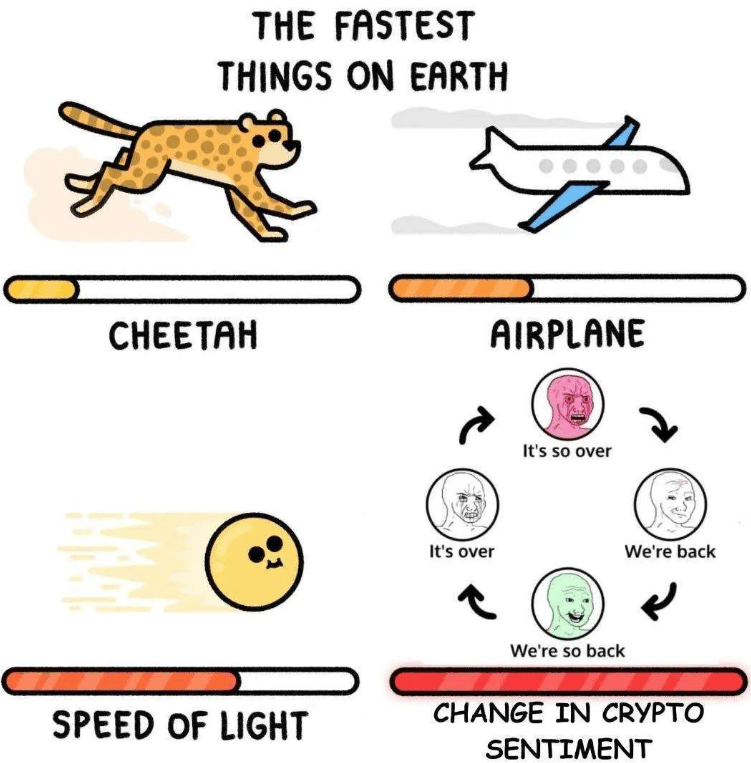

MEME OF THE DAY

How did you like today's newsletter? |

That’s it for today. Don’t forget to share Coinpaper Digest with your friends!